Co-blogger Kevin Corcoran wrote a recent post titled “Economics in Everyday Life.” He asked commenters to give examples of how they learned economics in their everyday lives. Every example I could think of in my own life was one that I had already posted on in previous blog posts. See here and here, for example. Notice that the second link was motivated by Kevin’s post.

I settled for giving a comment on Kevin’s recent post. I wrote: Down Warm Wasitcoat

One of the things that most economists, including me, believe is that pay is based on the value of one’s output. On the way to work this morning, I heard a song on my FM channel by a young woman complaining that she was underpaid. I realized how often I hear that. Then my next thought was that even when I was in my teens and working in part-time jobs, I always understood that pay was based on productivity. I never told myself I was underpaid. I would then figure out how to be more productive in a job or, more likely, because job performance was constrained in some ways, how to find a job in which I would be more productive.

That I understand the connection between pay and productivity gave me 3 good lessons: (1) the basic economic lesson that I laid out in my comment; (2) the idea that I shouldn’t whine when I got paid a low amount; and (3) the idea that if I wanted to make more money, I should go to a place where I could be more productive and where not a whole lot of people wanted to go.

I’ll focus here on (3). I started college at age 16. (My birthday was November 21 and so I slipped in under the wire for starting Grade One; we didn’t have kindergarten in my small town. And I was so bored in school that my parents decided to have me skip Grade Four. I found out later that a psychologist that my mother took me to in Brandon had advised against it because I would be emotionally immature relative to my new peers. I think he turned out to be right.) My father had given me the $1,600 (in 1967 $) that he had saved for my university years. He understood who I was and that I wouldn’t waste it. I had some savings and I worked summer jobs in the summer of 1967. By being very frugal and picking up various one-time chances to make money, and by earning scholarships, I had enough money to pay for 2 years of college tuition, books, room and board (although my father subsidized the room part), and very modest entertainment (no concerts, no drinking, and no going out for meals except for the occasional pizza.)

By May of 1969, I was down to a net worth of $20. I needed to make money to pay for my last year of university. (A standard degree in Canada took 3 years.) I thought, “What kind of job can I get where I could earn a lot of money in one summer?” I had been seeing ads for jobs in a nickel mine in Thompson, Manitoba. These jobs paid about $3.50 an hour in 1969 dollars. I didn’t have to think hard to realize that few young people would want to work in Thompson for a summer. Summer in Winnipeg was glorious: who would want to leave that?

So my friend Don Redekop and I, less than an hour after writing our last exam for the year, stood outside the University of Winnipeg and thumbed rides to Thompson. It took a day and a half to get there. We quickly found jobs building a mine and the jobs paid almost as much as the pay for working in a mine. Unfortunately, he and I were put in separate groups of workers our second day on the job and on the third day, my group was laid off en masse.

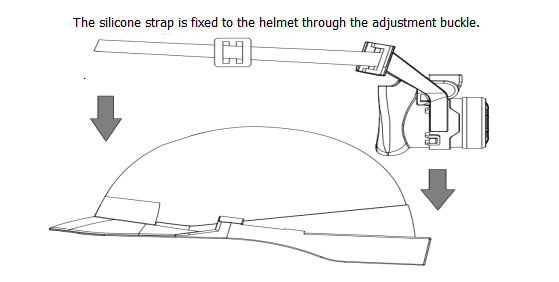

I had promised my father, who, when he thought of mines, thought of coal mines with all the attendant risks, that I would not work in a mine. I fully expected to keep that promise. But now that the summer was ticking away, I was desperate. So I went around Thompson applying for every well-paying job, whether in a mine, above a mine, or in a business that supplied to mines. After about 3 or 4 days, a diamond drilling company called me up (I was staying temporarily with Don’s sister) and I went down to their shop. I was hired on the spot and they had me pick out boots, slicks (rubber pants and top that you wore to repel water,) a belt, a helmet, and a light to fit on the helmet. A guy from the company who was delivering supplies to a mine 40 miles south of Thompson, out in the middle of frigging nowhere, drove me down that afternoon and I was to start that evening on the night shift.

Even from about age 6 on, I was a cautious kid. I didn’t refuse to take risks but I informed myself about risks and decided whether they were worth taking. So on that 50-minute ride, I asked the driver what kinds of risks there were in the mine. His answer was sobering. He told me that 2 miners in the mine I was going to (called Soab Lake) had been killed a day or two earlier by using degraded fuses to light some explosives. I knew that as a diamond driller’s helper I wouldn’t be dealing with explosives and that even if I had dealt with them, I would have taken the time to get fresh fuses. I also knew, at a gut level, even though I hadn’t yet read Adam Smith’s The Wealth of Nations and hadn’t read the subsequent economics literature on “compensating differentials,” in this case higher pay for taking risks, that risky jobs paid more. The risk plus the physical isolation were two things that led to higher compensation.

I started the job around May 15 and finished around August 15, a month before my 3rd year of university started. I worked every hour of overtime I could, and sometimes a day shift and a night shift in a row or a night shift and a day shift in a row. By August 15, I had enough money for a full year of college plus expenses, plus an extra $350 that I used to take a trip to an Intercollegiate Studies Institute seminar at Rockford College in Rockford, Illinois (my first ride in an airplane was from Winnipeg to Chicago on Northwest Orient Airlines), and then to take a further week to see Philadelphia and New York.

In one of my last conversations I had with my sister, before she died unexpectedly in 2018, she told me that when I returned to Winnipeg that summer, she thought of me as a man for the first time. I was 18 and she was 23. I thought it was because I had bulked out because we could eat all the food we wanted and it was good. Later a friend I told that story to told me that she probably saw more than that: possibly a certain maturity after I had been in a mining camp with 300 guys in the middle of the wilderness.

Lots of applying economics to my life.

A study of political attitudes among people in different professions found that miners and farmers tended to be the most conservative, while university professors and systems analysts were among the most progressive. While I have no idea how the study was conducted or how the researchers defined “conservative” and “liberal,” the findings seem reasonable to me.

My father was a mining engineer and, like Dr. Henderson, I got summer (and winter) jobs at mines. I also worked most of my career as a systems analyst. While I suppose that it’s possible that, as postmodernists claim, there are an infinite number of ways to interpret a text, there are very few that will keep you alive if you’re reading about, say, how to load explosives into a drill hole.

As a systems analyst, by contrast, I was working with constructed realities – realities that I had often constructed. If I made a mistake, no one died. I just debugged my code and tried again. Unlike computer jockeys, miners don’t have the luxury of infinite do-overs.

The more our actions are tied to concrete reality checks, the less likely we are to have luxury beliefs such as the idea that words relate only to other words and not to the real world.

Yes. In concrete work our mistakes are fixed with a jackhammer instead of a backspace key. I can get quite aggressive when someone is attempting to make us do something that experience shows doesn’t work.

Could you perhaps elaborate on the various one-off opportunities you took to make some extra money, please?

Sure. In my first year of college, an opportunity came along to tutor a high-school student in math. I charged $4 an hour, which I thought to be high. She paid promptly each time and then, for the last 2 hour session, stiffed me. Believe it or not, I still remember her name.

Because I had done so well in my first year of college, I applied to be a TA in the weekly calculus labs. I got paid $90 per half year. That’s not quite “one-off” but I categorized it as such because it took less than half an hour a week for me to go through all the questions they would work and figure out the answers and then another hour or two to go around the room helping students.

If only students today had the same mentality that they could work hard, taking extra shifts, and be able to get through college with little or no loans.

What's the freest state in America? According to a study by political scientists William Ruger, president of the American Institute for Economic Research (AIER), and Jason Sorens, a senior research faculty member at AIER, it's New Hampshire. In the 7th edition of their study of freedom in the 50 states, they report ...

Matt Yglesias has a post entitled: Trump would make inflation worse I have a slightly different view. I'd make the following two claims: 1. Trump would not make inflation worse. 2. Trump would make "inflation" worse. That obviously calls for an explanation. Economists define inflation as the per...

Co-blogger Kevin Corcoran wrote a recent post titled "Economics in Everyday Life." He asked commenters to give examples of how they learned economics in their everyday lives. Every example I could think of in my own life was one that I had already posted on in previous blog posts. See here and here, for example. Notice...

Enter your email address to subscribe to the Econlib monthly newsletter.

Thermal Glove © 2023 Econlib, Inc. All Rights Reserved. Part of the Liberty Fund Network.